Introduction

In the world of Forex trading, fundamental analysis plays a crucial role in understanding price movements and market trends. While many traders rely solely on technical analysis, incorporating fundamental analysis can provide deeper insights into market behavior, allowing for more informed trading decisions. In this article, we will break down the key aspects of fundamental analysis, how economic data impacts currencies, and how traders can effectively use this information to enhance their trading strategies.

What is Fundamental Analysis in Forex Trading?

Fundamental analysis in Forex involves evaluating macroeconomic indicators, central bank policies, geopolitical events, and overall economic conditions to determine the strength or weakness of a currency. Unlike technical analysis, which focuses on price action and chart patterns, fundamental analysis seeks to understand the underlying forces driving market movements.

Why is Fundamental Analysis Important?

Economic data releases create liquidity and volatility, two essential elements for active traders. These factors drive price action in the short term while also shaping long-term trends. The general belief in Forex trading is that markets will follow economic numbers, making fundamental analysis a critical component of a trader’s toolkit.

Key Economic Indicators That Impact Forex Markets

Understanding which economic indicators influence currency prices is essential for making informed trading decisions. Below are some of the most impactful fundamental factors:

1. Interest Rates

Interest rates play a pivotal role in currency valuation. Higher interest rates attract foreign investment, increasing demand for that currency and causing it to appreciate. Conversely, lower interest rates discourage investment, leading to currency depreciation.

📌 Example: If the U.S. Federal Reserve raises interest rates while the European Central Bank keeps rates steady, the USD is likely to strengthen against the EUR.

2. Inflation Rates (Consumer Price Index – CPI)

Inflation measures the increase in prices of goods and services over time. Moderate inflation is generally positive for a currency, but excessive inflation can lead to economic instability and depreciation of the currency.

📌 Example: If inflation rises too high, central banks may increase interest rates to control it, which can strengthen the currency.

3. Employment Data (Non-Farm Payrolls – NFP)

Employment figures reflect the strength of an economy. Higher employment numbers indicate a strong economy, boosting investor confidence and strengthening the currency.

📌 Example: A better-than-expected U.S. NFP report can lead to USD appreciation as it signals economic growth.

4. Gross Domestic Product (GDP)

GDP measures the total value of goods and services produced within a country. A growing GDP is a bullish signal for a currency, while a declining GDP can weaken it.

📌 Example: If the UK’s GDP shows strong growth, it could lead to an increase in the value of the GBP.

5. Trade Balance

A trade surplus (more exports than imports) strengthens a currency, while a trade deficit (more imports than exports) weakens it.

📌 Example: If Japan reports a trade surplus due to strong exports, the JPY may strengthen as foreign demand for Japanese goods increases.

How to Interpret Economic News for Trading Decisions

Understanding how to react to economic news is crucial in Forex trading. Here’s a step-by-step approach:

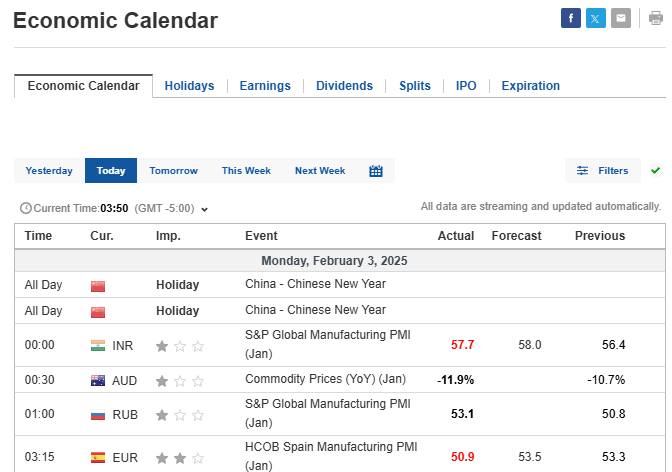

Step 1: Monitor the Economic Calendar

Traders should regularly check economic calendars (e.g., Forex Factory, Investing.com) to stay updated on upcoming data releases and central bank meetings.

Step 2: Identify Market Expectations

Before an economic report is released, analysts and economists provide forecasts. If actual data significantly deviates from expectations, it can cause sharp market movements.

📌 Example: If analysts expect U.S. job growth of 200,000 but the actual figure is 100,000, the USD might weaken due to weaker-than-expected employment data.

Step 3: Analyze Market Reaction

Markets react instantly to news releases. A positive economic report does not always result in a bullish movement if expectations were already priced in.

📌 Example: If the European Central Bank raises interest rates as expected, but their policy statement is dovish (suggesting no further hikes), the EUR might still fall despite the rate hike.

Combining Fundamental and Technical Analysis

To maximize trading efficiency, traders should integrate both fundamental and technical analysis.

Confirming Technical Setups with Fundamentals

If your technical analysis shows a bullish trend on EUR/USD and strong Eurozone data supports it, the trade setup is reinforced.

Risk Management During High-Impact News

Major news events cause volatility. Traders should adjust stop losses and take profits accordingly to manage risk.

Using Sentiment Analysis

Market sentiment can override fundamentals. For example, even if a central bank raises interest rates, market sentiment driven by fear (e.g., geopolitical tensions) can lead to unexpected price movements.

Related Article: Mastering Risk Management: The 6 Key to Profitable Trading

Major Market Participants and Their Role

Understanding who influences Forex markets can help traders anticipate market movements.

1. Central Banks & Financial Institutions

- Federal Reserve (FED) – USA

- European Central Bank (ECB) – Eurozone

- Bank of England (BOE) – UK

- Bank of Japan (BOJ) – Japan

- People’s Bank of China (PBOC) – China

- International Monetary Fund (IMF)

Central banks set interest rates and implement monetary policies that directly impact currency values.

📌 Example: If the BOJ intervenes to weaken the JPY to boost exports, the USD/JPY pair might rise.

2. Credit Rating Agencies

- Standard & Poor’s (S&P)

- Moody’s

- Fitch Ratings

Credit rating downgrades can weaken a country’s currency as investors lose confidence in the economy.

📌 Example: A downgrade of UK’s credit rating could cause GBP/USD to decline.

Understanding forex fundamental analysis

Key Forex News Events and Their Impact

1. Non-Farm Payrolls (NFP) Report

NFP is one of the most volatile events in Forex trading. Released on the first Friday of each month, it measures job creation in the U.S. economy (excluding farming jobs).

📌 Impact: If NFP is strong, USD strengthens; if weak, USD weakens.

2. Central Bank Meetings & Rate Decisions

Interest rate hikes are bullish for a currency, while cuts are bearish.

📌 Example: If the Fed unexpectedly raises rates, USD pairs will likely rise sharply.

3. Unexpected Economic Policies (e.g., Quantitative Easing – QE)

QE increases money supply, which can devalue a currency.

📌 Example: If the BOE announces QE, GBP/USD may drop.

Practical Tips for Using Fundamental Analysis in Forex

- Create a morning routine: Check economic calendars and news updates before trading.

- Be cautious around major news releases: High volatility can trigger stop losses.

- Use stop-loss orders: Protect against unexpected price swings.

- Combine fundamentals with technicals: Look for confluence in trading setups.

Conclusion

Fundamental analysis is a powerful tool in Forex trading. By understanding economic indicators, central bank policies, and global events, traders can make more informed decisions and increase their chances of success. Combining fundamental and technical analysis can further enhance trading strategies, helping traders navigate the ever-changing Forex market with confidence.

By staying informed and continuously learning, you can gain an edge over the market and improve your overall trading performance.