Top 3 Forex Prop Firms: In-Depth Review & Comparison

Introduction

Prop firms have become a game-changer for forex traders looking to scale their capital without personal financial risk. However, not all prop firms are created equal—some are reliable and trader-friendly, while others can be scams or impose restrictive conditions.

In this guide, we’ll rank the top three prop firms based on personal experience, payout reliability, trading conditions, and overall trader benefits. If you’re considering joining a prop firm, this detailed breakdown will help you make an informed decision.

3rd Place: The 5%ers

Pros of The 5%ers

1. Established and Trustworthy

Founded in 2016, The 5%ers have a strong track record spanning over eight years. Compared to many newer firms, they offer stability and lower risk of shutting down or failing to pay traders.

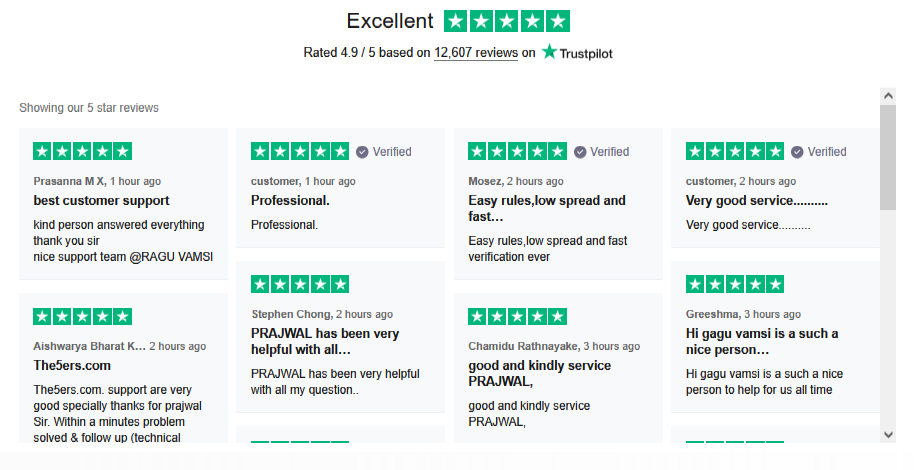

2. Positive Trader Feedback

With a Trustpilot rating of 4.9 stars from over 8,700 reviews, The 5%ers have built a strong reputation for reliability.

3. Regular Payouts

The firm provides bi-weekly payouts (every 14 days) for their two-phase challenge, ensuring traders can access their profits without delays.

4. Fair Trading Rules

The 5%ers offer reasonable trading conditions, including flexible drawdown limits. Additionally, they refund the challenge fee with the first payout—a feature absent in some other firms like E8 Markets and MyFundedFX.

5. Trader-Focused Approach

The firm prioritizes trader growth by offering one-on-one performance coaching, free webinars, and educational content.

6. Multiple Funding Programs

- High-Stakes Program: A two-phase challenge with an 8% profit target in Phase 1. A 100K challenge costs $495, which is cheaper than FTMO’s $540.

- Bootcamp Program: A three-phase challenge designed for beginners. Traders pay a small upfront fee and complete payments only upon passing.

- Hypergrowth Program: An instant funding option with no challenge required.

Cons of The 5%ers

1. Limited Account Scaling

Traders can only hold three accounts at any given time, capping the maximum two-phase challenge funding at $125,000—significantly lower than other firms offering $400,000+ funding.

2. Minimum Profitable Days Requirement

The two-phase challenge requires three profitable days with at least 0.5% profit per day. For example, on a 100K account, traders must earn $500 or more for three separate days.

3. Leverage & Risk Limits

- The Bootcamp Program enforces a mandatory stop-loss rule and a 2% max risk per trade.

- The Hypergrowth Program offers lower leverage than many competitors.

2nd Place: FundedNext

Pros of FundedNext

1. Fast and Reliable Payouts

FundedNext offers a 24-hour payout guarantee—if they fail to process a payout within this time frame, they compensate traders with an additional $1,000.

2. High Trustpilot Rating

With over 22,000 reviews and a 4.5-star rating, FundedNext has a solid reputation. However, since Trustpilot reviews can sometimes be unreliable, it’s best to cross-check trader experiences in forex communities.

3. Multiple Challenge Options

FundedNext offers four challenge types:

- Stellar Challenge

- Stellar Light Challenge

- Express Challenge

- Evaluation Challenge

Each challenge caters to different trader needs, with varying profit targets, drawdowns, and fees.

4. Profit Sharing During Challenges

Traders can earn 15% profit share during the challenge phase if they grow their funded account by 5%. However, upon reaching the FundedNext Account, traders will get an 80% Profit Share and can be eligible for a 90% Profit Share through Scale-Up.

5. Competitive Trading Conditions

- Low Commissions: $3 per lot on forex and commodities, $0 on indices and crypto.

- 24/7 Customer Support: Live chat is always available to assist traders.

Cons of FundedNext

1. Higher Challenge Costs

While the Stellar Light Challenge is more affordable, it has stricter drawdown limits (4% daily, 8% overall). The standard challenge fees are higher than those of some competitors.

2. Increased Commission on Some Accounts

Some accounts have commissions as high as $7 per lot, which can impact scalpers and high-frequency traders.

3. Stricter Evaluation Program

The Evaluation Challenge has a 10% profit target in Phase 1 with a time limit, making it harder to pass than the two-phase Stellar Challenge.

1st Place: FTMO

Pros of FTMO

1. Industry Leader & Established Reputation

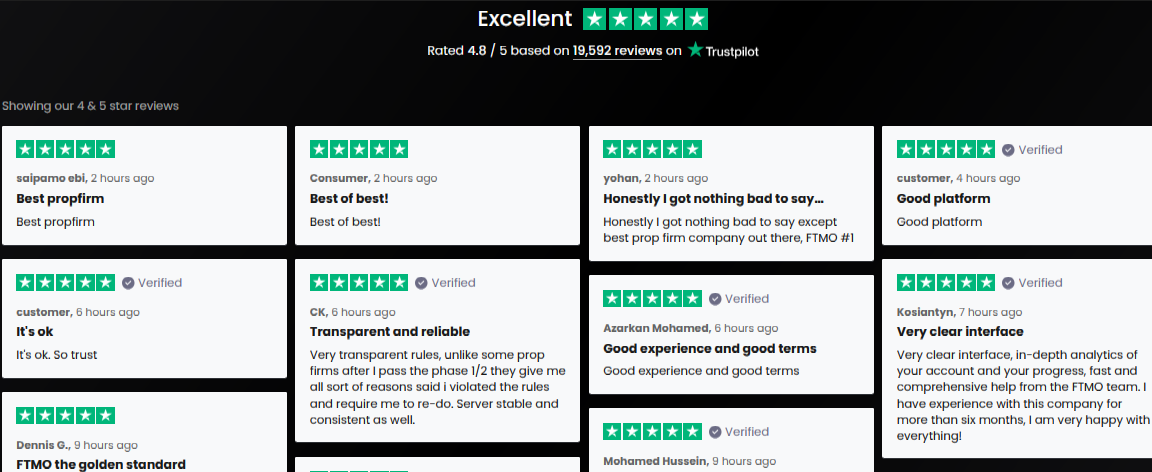

FTMO has been operating since 2015 and is considered the gold standard among prop firms. With a 4.8-star Trustpilot rating from over 15,700 reviews, FTMO is one of the most trusted names in the industry.

2. Guaranteed Payouts

FTMO has never missed a payout in its history, making it one of the most reliable options for traders.

3. Excellent Trading Conditions

- Tight spreads and low slippage

- Low commission fees

- Advanced trading platforms with institutional-grade execution

4. Challenge Fee Refunds

FTMO refunds the challenge fee upon successful completion of the challenge and verification phases, a feature that increases its value.

5. Superior Customer Support

FTMO’s support team is available 24/7 and is widely regarded as one of the best in the industry, with quick response times and helpful representatives.

Cons of FTMO

1. High Challenge Fees

FTMO has some of the most expensive challenge fees in the industry. For example, a 100K challenge costs $540, compared to The 5%ers’ $495.

2. Weekend Trading Restrictions

Traders must close positions before the weekend unless the rollover is under two hours.

3. Strict News Trading Rules

FTMO has strict guidelines regarding trading during high-impact news events, which can be limiting for traders who rely on news-based strategies.

4. Risk Management Restrictions

Although not explicitly stated, traders who risk too much per trade may receive warning emails asking them to reduce their risk exposure.

Final Thoughts: Which Prop Firm is Best?

- If you want a well-established firm with guaranteed payouts and top-tier trading conditions, FTMO is the best choice.

- If you prefer a mix of reliable payouts and multiple challenge options, FundedNext is a solid alternative.

- If you’re a beginner looking for a cost-effective way to start, The 5%ers Bootcamp Program is worth considering.

Each firm has its own strengths and weaknesses, so your choice should depend on your trading style, budget, and growth goals. If you’re looking to scale your forex career with a prop firm, make sure to research their conditions thoroughly before taking a challenge!

Summary

In this article, we discussed the top three prop trading firms based on our own personal experience and payout history. The analysis is informed by encounters with different prop firms, including both positive experiences and instances of scams. This article aims to help viewers make informed decisions about which prop firm to choose by summarizing the pros and cons of each firm. The firms highlighted include 5%ers, Funding Next, and FTMO, each of which has unique offerings, payout structures, and challenges for traders. We also emphasizes the importance of conducting thorough research before committing to any prop firm, especially to avoid pitfalls they have encountered in the past.

HIGHLIGHTS

📈 5%ers Established Reputation: Launched in 2016, 5centers has a solid track record with favorable Trustpilot ratings.

⏰ Fast Payouts: 5%ers offers payouts every 14 days, and refunds the challenge fee upon the first payout.

🔄 Funding Flexibility: 5%ers provides various funding programs, catering to different trader needs, including a low-cost entry boot camp.

💰 Funding Next’s Unique Guarantee: Funding Next promises a 24-hour payout guarantee, incentivizing timely processing.

🏆 FTMO’s Gold Standard: FTMO is recognized as a top-tier prop firm with a strong reputation and reliable payouts since 2015.

🔒 Strict Trading Conditions: While FTMO has many advantages, it also imposes strict trading rules, such as mandatory position closures before weekends.

🎓 Support and Education: All three firms offer varying levels of customer support and educational resources to help traders succeed.

Key Insights

🌟 5%ers’ Longevity: The firm’s establishment in 2016 provides a level of trustworthiness that newer firms often lack. With 4.9-star ratings from over 8,700 reviews on Trustpilot, their reputation in the industry is solid, making them a dependable choice for traders looking for stability.

📊 Payout Structure: 5%ers’ biweekly payout cycle is a significant advantage for traders needing liquidity. The refund of the challenge fee upon the first payout further enhances the appeal, establishing a risk-reduced entry point for new traders.

📅 Diverse Programs: Offering three distinct funding programs, including a boot-camp for beginners and an instant funding option, 5%ers caters to traders at various skill levels. This adaptability allows traders to choose a program that aligns with their trading style and experience.

🔍 Payout Reliability with Funding Next: Funding Next’s unique 24-hour payout guarantee is a standout feature that differentiates it from competitors. Traders can feel confident that their payouts will be processed quickly, and the additional $1,000 incentive for delays underscores the firm’s commitment to customer satisfaction.

🎯 Challenge Types: Funding Next offers various challenge types tailored to different trader experiences, including the Stella and evaluation challenges. However, prospective traders should be cautious of the higher fees associated with some challenges and the stricter drawdown limits that may come with lower-cost options.

🥇 FTMO’s Reputation: FTMO is often viewed as the industry benchmark due to its long-standing presence and reliable payment history. The firm has a solid 4.8-star rating on Trustpilot, indicating high customer satisfaction and trust.

⚖️ Trading Restrictions: While FTMO offers many advantages, such as low spreads and excellent customer support, its strict rules around position management and risk levels may be challenging for some traders. Understanding these restrictions beforehand is crucial for successful trading.

What’s Next?

If you have any questions or experiences with these prop firms, feel free to share them in the comments below. For more in-depth trading tips and prop firm reviews, stay tuned for our upcoming content!